Motor Vehicle Insurance A car is a huge investment, so it’s natural to want to protect ourselves from driving risks… And, of course, accidents.

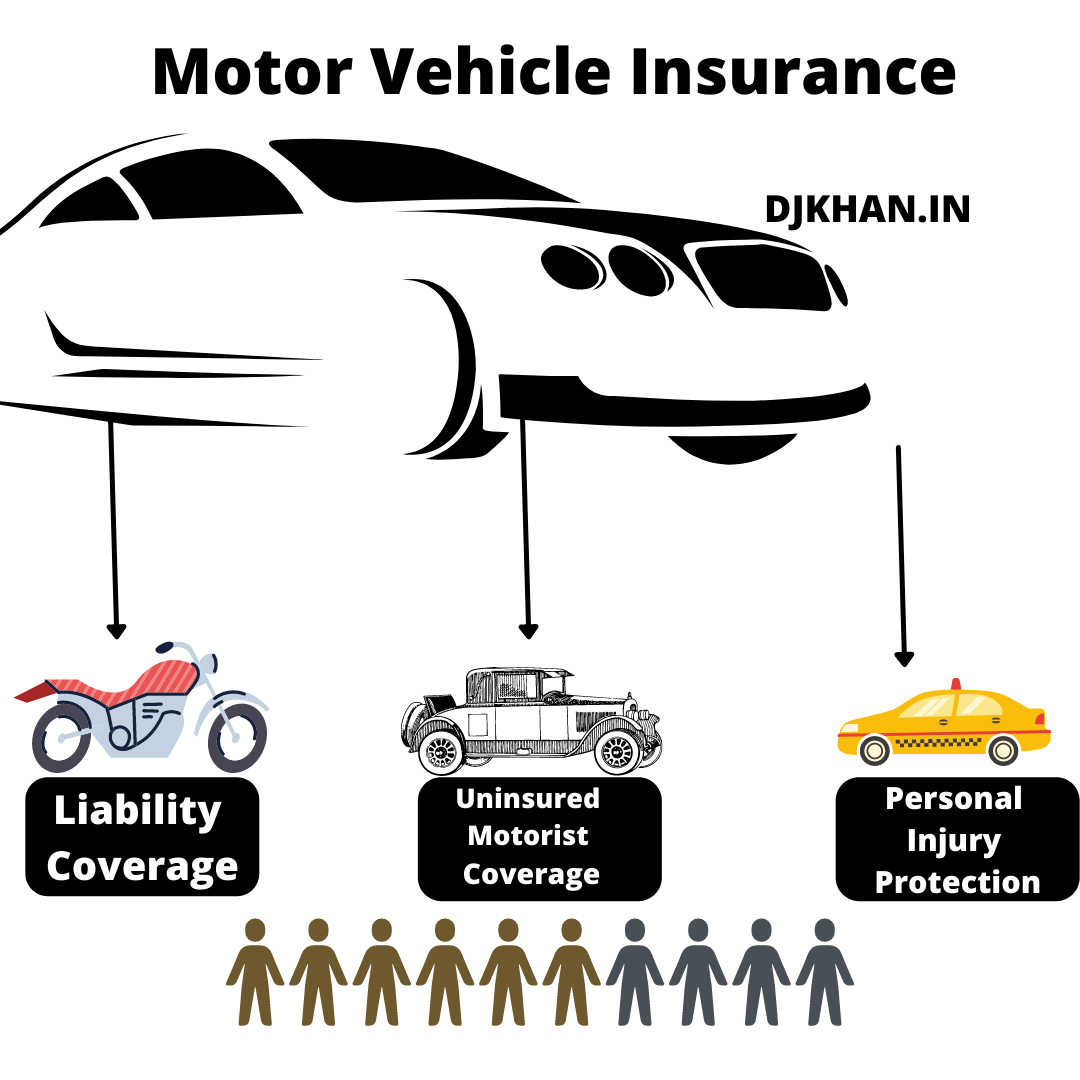

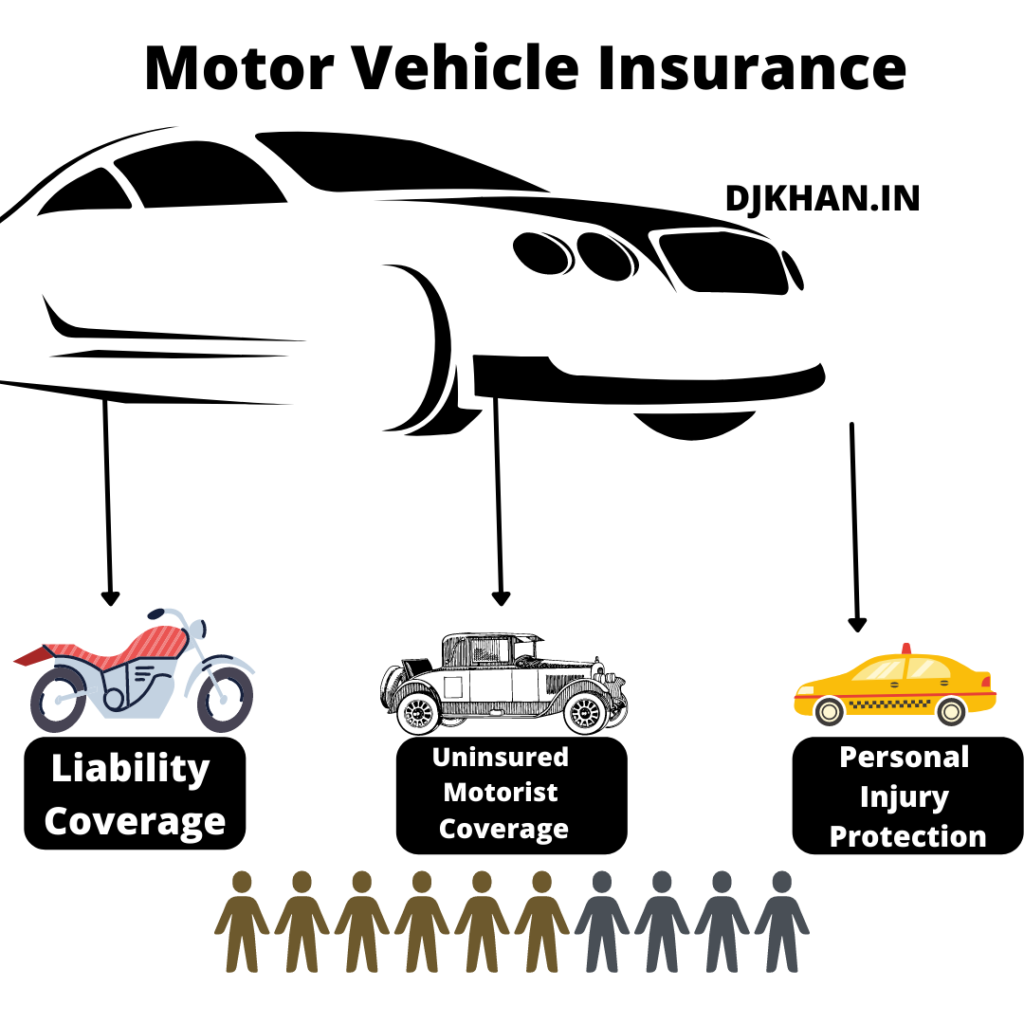

Types Of Motor Vehicle Insurance

It’s important to have an understanding of the three most common types of motor vehicle insurance available

1Liability Coverage 2. Uninsured Motorist Coverage 3. Personal Injury Protection.

- Liability Coverage can be thought of as your “basic” coverage for what happens when you get in an accident and hurt someone or damage their property. This is require by law in some states and optional in others. it depends on the policyholder. If liability coverage can be waive (or it’s optional), you’ll need to make sure the other driver carries adequate protection.

2. Uninsured Motorist Coverage covers you if you’re involve in an accident with a driver who isn’t insure for some reason (getting into a fender bender with unsure Motorist Coverage covers you if you’re involve in an accident with a driver who isn’t insure for some reason (getting into a fender bender with while both of you are driving uninsured is not a good look). This is an optional coverage, but it’s recommend by the Insurance Institute of Highway Safety.

3. Personal Injury Protection (or PIP) covers your medical bills. If you’re injure in a car accident. This is an optional coverage, but it’s a pretty great one to have. It’s also require in many states.

Tips for choosing insurance policies

Choosing the right insurance policy is all about weighing the pros and cons of different types of coverage. For example, you may be able to get liability coverage for a low premium if you have a clean driving record. But you may be charged a higher premium if you have had a ticket in the past.

Motor Vehicle Insurance Essentials/Points

Vehicles are an important asset and it is natural to protect yourself from the risks of driving. However, accidents are not a common occurrence, and therefore it is important to have motor vehicle insurance.

Motor vehicle insurance protects you and your vehicle from the potential costs of an accident. It also covers you in the event of an accident. It is important to understand the different types of motor vehicle insurance available, as well as the advantages and disadvantages of each.

To make sure you’re getting the best deal, it’s important to understand the different types of coverage available. It can help you get the best coverage for your situation.

You should always compare motor vehicle insurance policies to get the best deal. Be sure to compare all the different types of coverage and find the best policy for your needs.

Motor Vehicle Insurance Plans

If you have a good driving record, you may be able to get discounts for things like low-speed driving. Being a student or if you have been insure by the same company for a long time.

Check your coverage limits. You can get a better deal on liability coverage if you have higher limits. Your limits are the amount of money that you are legally responsible for paying in a case where you cause an accident.- Think about your needs. If you are a young driver,

you may want to get liability coverage for your own car, but you may not need coverage for your parents’ car.

Look at your personal situation. If you live in an area with high insurance costs, you may want to get a policy that has higher limits to reduce your costs.

Make sure you are getting enough coverage. In many states, you need liability coverage of at least $10,000 per person and $20,000 per accident.

Documents required for motor vehicle insurance

- Aadhar card

- passport size photo

- Driving License, Pan Card and Light Bill

- Address proof

Types of Motor Vehicle Insurance

Check your policy and get a copy of your coverage. Review your policy carefully, making sure you understand the different coverages and the different types of liability coverage. Get a make sure your policy covers everything you need. Be sure to get your policy renew at least once a year. You may be able to get a discount for bundling your auto and home insurance with the same company.

If you’re in a car accident with an uninsured driver, Uninsured Motorist Coverage pays for your damages up to the amount of your liability insurance.

Personal Injury Protection (PIP) covers the medical costs of you and any passengers in the car.

What is an auto insurance premium?

- If you have liability coverage, your premium will be based on the following factors:

- Age: You’re at greater risk for a car accident if you’re older. The price of your insurance will increase accordingly.

- Driving record: If you’ve had an accident or received a traffic citation, your premium will be higher.

- Geography: Your premium will be higher if you live in a rural area, on the West Coast, or in a cold-weather climate.

Share This<< Facebook

Related Post<<How to Apply for a Small Business Loan